Over the recent past, medical equipment industry has been one of the rapidly growing segments in the industry arena. Marking a 4.6% growth rate over the previous year, Indian medical equipment industry was valued for USD1318m in the year 2005. Owing to several factors that are found to boost up the production of medical equipments, this industry segment is expected to grow by 12% annually to reach $6 billion in 2015. Medical equipments and devices are those that are used for diagnosis, therapy and patient monitoring. In India, medical supplies and disposables market is seen dominated by domestic firms while importers enjoy a leading role in supplying expensive and high end medical equipments. One of the most important factors that have contributed to the growth of medical equipment industry in the world and especially in India is the rapidly increasing rate of health care expenditure among people. The other factors that boost up the industry include the fast changing demographic profile due to the growing old age population, multiplying instances of life style diseases such as cancer, CNS and diabetics, etc. The global scenario reports an increased awareness and affordability combined with a growing patient pool leading to a significant increase in demand for medical equipments and supplies year after year.

Over the recent past, medical equipment industry has been one of the rapidly growing segments in the industry arena. Marking a 4.6% growth rate over the previous year, Indian medical equipment industry was valued for USD1318m in the year 2005. Owing to several factors that are found to boost up the production of medical equipments, this industry segment is expected to grow by 12% annually to reach $6 billion in 2015. Medical equipments and devices are those that are used for diagnosis, therapy and patient monitoring. In India, medical supplies and disposables market is seen dominated by domestic firms while importers enjoy a leading role in supplying expensive and high end medical equipments. One of the most important factors that have contributed to the growth of medical equipment industry in the world and especially in India is the rapidly increasing rate of health care expenditure among people. The other factors that boost up the industry include the fast changing demographic profile due to the growing old age population, multiplying instances of life style diseases such as cancer, CNS and diabetics, etc. The global scenario reports an increased awareness and affordability combined with a growing patient pool leading to a significant increase in demand for medical equipments and supplies year after year.

The economic recession around the globe is found to crush almost all the businesses without an exception. However, the medical equipment industry in India is expected to come out of this dreadful scene rather unscathed. While the demand for healthcare in India is not directly tied to the discretionary spending habits of consumers, an affordable and knowledgeable patient population in the country continuously demands advanced health services. Taking benefit of this encouraging scenario, corporate hospital groups in the country are fast building up improved healthcare infrastructure to thereby building a strong base for the medical equipments industries to market their supplies.

The economic recession around the globe is found to crush almost all the businesses without an exception. However, the medical equipment industry in India is expected to come out of this dreadful scene rather unscathed. While the demand for healthcare in India is not directly tied to the discretionary spending habits of consumers, an affordable and knowledgeable patient population in the country continuously demands advanced health services. Taking benefit of this encouraging scenario, corporate hospital groups in the country are fast building up improved healthcare infrastructure to thereby building a strong base for the medical equipments industries to market their supplies.

History of Medical Equipments Manufacturing

Manufacturing of medical equipments has a unique and interesting history. Pulse rate measuring device was the first precision medical instrument released for use in the seventeenth century. This was the first ever known medical instrument in the healthcare sector. The device featured a pendulum comprising a cord and weight. The diagnostic procedure included measuring the pulse rate by adjusting the weight till the pendulum swung at an even tempo with the patient’s pulse. Following this invention, a wide range of medical equipments have been bombarding the market lifting the segment with an advanced technical sweep.

Indian Medical Equipment Industry: Overview

In India, diagnostic kits have emerged as a rapidly booming segment. Some of the potential factors that drive the growth of medical equipments industry in India are the growing affordability among patients, fast growing awareness regarding healthcare, highly enhanced infrastructure in hospitals and the multiplying disease patterns. With an annual growth rate of 23%, the medical equipments and supplies market in India has touched USD 1.7 billion in the year 2010. High quality medical devices industry in India has also been significantly benefited from the liberal market environment, a sophisticated industry scenario and growing investments in health infrastructure.

In India, diagnostic kits have emerged as a rapidly booming segment. Some of the potential factors that drive the growth of medical equipments industry in India are the growing affordability among patients, fast growing awareness regarding healthcare, highly enhanced infrastructure in hospitals and the multiplying disease patterns. With an annual growth rate of 23%, the medical equipments and supplies market in India has touched USD 1.7 billion in the year 2010. High quality medical devices industry in India has also been significantly benefited from the liberal market environment, a sophisticated industry scenario and growing investments in health infrastructure.

Among the various segments of the medical equipments market, manufacture of diagnostic equipment has taken a lead over others having crossed Rs. 2,000 crore during this year, while surgical equipments segment has been valued to have crossed Rs. 1,300 crore. The third place is enjoyed by the imaging devices valued at Rs. 1,300 crore, while the worth of electronic treatment devices has been estimated at Rs. 1,000 crore.

Medical equipment market in India is found to be dominated by the devices and appliances used by specialized fields like dental, ophthalmic and a number of other physiological categories. This industry segment alone has captured about 26% of the medical equipment market while the orthopedic equipments segment is estimated to have stretched over to engulf more than 19% of the total market.

Medical supplies like bandages and disposable goods like catheters, syringes and needles together make up 21% of the total market. The other medical equipments that follow in order of the demand are high end specialty electro medical equipments valued to occupy 11% of the total market and X-ray device that accounts for 10% of the total market.

One another fast growing segment in the Indian medical equipments arena are the diagnostic kits that enjoy an average growth rate of 30% year after year. This segment includes reagents and medical kits. In India, there are more than 50 top brands manufacturing diagnostic kits. The leading player in this arena is Roche Diagnostics ably followed by Transasia, Bayer and a number of others including Span Diagnostics, Piramal Healthcare, Orchid, Tulip Diagnostics, Zephyr Biomedical Biorad and Liliac.

Recent trends in the medical equipments industry have seen privately run corporate hospitals outsourcing their laboratory services and raising private equity funds. For instance, Metropolis Health Services, a Mumbai based firm has been managing the laboratory of Malar Hospital based in Chennai. Metropolis is also managing the laboratory services of Gulf Medical College in Ajman (Dubai). Most leading healthcare firms in India have engaged themselves in raising funds through private equity to meet the demands of their vigorous expansion and needs of upgrading their infrastructure.

Recent trends in the medical equipments industry have seen privately run corporate hospitals outsourcing their laboratory services and raising private equity funds. For instance, Metropolis Health Services, a Mumbai based firm has been managing the laboratory of Malar Hospital based in Chennai. Metropolis is also managing the laboratory services of Gulf Medical College in Ajman (Dubai). Most leading healthcare firms in India have engaged themselves in raising funds through private equity to meet the demands of their vigorous expansion and needs of upgrading their infrastructure.

Imports of medical equipments in India constitute about 50% of the market. Most of the hi-tech imported products are reported to have gross margins. At present, some of the high value medical equipments imported by India include diagnostic devices for cancer, imaging technology gadgets, ultrasonic scanning devices, plastic surgery equipments and technologies for polymerase chain reaction. On the other hand, the market scenario in India is turning more competitive due to low entry barriers noticed for multinational players in addition to a rapidly widening customer base.

The medical equipment market pertaining to exports from India is valued at about USD 509 million with a CAGR of 22.15%. Some of the important instruments exported from India include dental instruments, surgical items and a range of medical laboratory equipments.

Some of the most popular MNC’s operating from India are B Braun, Becton, Dickinson and company, Bayer, Johnson and Johnson, Phillips , Roche, Siemens and GE. In addition, there are also a number of domestic firms that have firmly established their presence in the Indian market like BPL Healthcare, Godrej Healthcare, Nicholas Piramal India Ltd., Opto Circuits India Ltd. and Advanced Micronic Devices Ltd.

Though the growth rate of firms manufacturing medical equipments in India is very strong, the market still remains strangely small, having been ranked among the top 20 in the world, but reporting a very low rate of per capita spending.

Talking of the scenario related to medical equipments market in India, there are a number of issues that cripple its performance like the country’s dependency on imports with regard to medical devices supply, stringent regulations governing the industries, very low level of healthcare insurance and lack of adequate healthcare facilities and awareness particularly in rural areas.

Talking of the scenario related to medical equipments market in India, there are a number of issues that cripple its performance like the country’s dependency on imports with regard to medical devices supply, stringent regulations governing the industries, very low level of healthcare insurance and lack of adequate healthcare facilities and awareness particularly in rural areas.

Medical equipments supply in India is primarily dependent on the imports from a number of other countries including the US, Japan, the UK, France, Finland and Germany, etc. Estimates value that about 50% of India’s medical equipments sales is realized through imports.

A major part of the medical equipments manufactured domestically in India low technology products. Surgical textiles and a number of other medical supplies are some to name a few, while the demand for hi- tech goods is satisfied predominantly by imports.

Recent trends in Medical Equipment industry

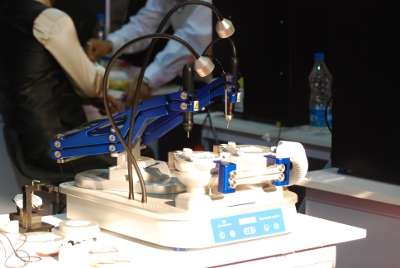

Automation and Robotics

Increasing number of manufacturers in the medical equipments arena are concentrating on machines that are made to automate complicated and precise operations. These equipments can perform a range of tasks including assembly and dispensing of medical devices, automation of labs, tending machines, handling materials, electronic assembly and packaging. In response to the competitive environment, the industry has started manufacturing automated medical equipments that can simultaneously process multiple work pieces.

Increasing number of manufacturers in the medical equipments arena are concentrating on machines that are made to automate complicated and precise operations. These equipments can perform a range of tasks including assembly and dispensing of medical devices, automation of labs, tending machines, handling materials, electronic assembly and packaging. In response to the competitive environment, the industry has started manufacturing automated medical equipments that can simultaneously process multiple work pieces.

Pharmaceutical Software

The computer friendly environment today necessitates the development of pharmaceutical IT solutions across a variety of requirements. Today, there is software connected to every activity across different segments in the pharmaceutical industry. A number of firms are evolving sophisticated solutions for pharmaceutical sales, stock maintenance and MIS. There are a number of accounts management software for managing a set of tasks including invoicing, control of inventory, sales and purchase, processing orders, MIS and accounting.

Laser Processing

The highly evolved manufacturing technology has resulted in a remarkable growth in the pharmaceutical industry. Today, advanced laser die-cutting systems meant for quick prototyping operations are being developed. There are also laser processing systems developed to integrate automated material handling operations with high-tech linear and rotary motion resulting in accurate and enhanced throughput. In addition, we can also make a mention of station platforms manufactured primarily for a variety of applications in the medical arena in order to integrate laser marking and welding to produce turnkey system. Pharmaceutical industry also employs laser welding and cutting technology in the arena of assembling miniature components.

The highly evolved manufacturing technology has resulted in a remarkable growth in the pharmaceutical industry. Today, advanced laser die-cutting systems meant for quick prototyping operations are being developed. There are also laser processing systems developed to integrate automated material handling operations with high-tech linear and rotary motion resulting in accurate and enhanced throughput. In addition, we can also make a mention of station platforms manufactured primarily for a variety of applications in the medical arena in order to integrate laser marking and welding to produce turnkey system. Pharmaceutical industry also employs laser welding and cutting technology in the arena of assembling miniature components.

Scope of Indian Medical Equipment Industry

Industry predictions state that the Indian medical equipment supplies industry is most likely to reach a value of US$ 7 billion by the year 2012 as there is an impending possibility of a huge number of public and privately owned healthcare facilities to shoot up in several locations across the lengths and breadths of the country particularly in metros and other budding satellite town where economic activities are concentrated, estimates The Associated Chambers of Commerce and Industry of India (ASSOCHAM). The organization’s paper published on Healthcare Services, it is stated that the present domestic medical equipment suppliers size is touching somewhere about US$ 3 billion.

The forecasts made above are based on the fact that manufacture and supply of medical equipment have already stretched their plans as a significant number of healthcare facilities are being rapidly added in metros and in satellite town located adjacent to metros as these townships are at present being promoted vigorously to accommodate industrial development.

It is estimated that many such facilities will come up through initiatives both in the public and private sectors in which many top players offering healthcare facilities would forge alliances with the healthcare facilities owned by the state. Therefore, it is obvious that medical equipment suppliers will have to perform a crucial role in meeting the emerging needs to establish world class laboratories and other centers in such facilities, said D S Rawat, Secretary General ASSOCHAM.

The paper published by ASSOCHAM also indicates that a number of players in the private equity segment have begun experimenting with ways to invest in such healthcare facilities. Latest estimates state that the private equity investments in healthcare facilities in hospitals and in the medical equipment supplier segment will be more than US$ 50 billion.

The medical equipment industry in India is considered as a high capital sector with a relatively longer gestation period. In addition, the industry players in India opine that the sector is low on innovation and therefore it does not fully justify the investments required.

Over and above, medical equipment needs are purely dependent on the type of services and facilities offered by healthcare providers, while in majority cases, the Indian firms only concentrate on the minimum requirements taking into account cost and number. This scenario renders it extremely difficult for new entrants to get the share enough to meet their operational and survival needs. Therefore, investors think back on investing in this sector.

Most of the equipment in the Indian market is imported, especially from the USA. However, in the past few years there has been a mushrooming of Indian players who cater to the demands of the quality conscious private hospitals as well as the cost conscious public government hospitals.

Some of the most popular Indian companies that have created a niche in the medical equipments manufacturing sector include Medived Innovations, Opto Circuits and Trivitron Healthcare. Despite these firms manufacturing a range of niche products of international standards, it is said that their primary focus is on exports rather than meeting the demands of the domestic market in India. However, most experts in this arena state that these firms will eventually be forced to increase their focus on Indian market, owing to the stringent regulatory requirements besides the cost dynamics.

GE, Philips, Johnson and Johnson, and Siemens are some of the multinational players in the Indian medical equipments industry. In late 2008, Philips India acquired Meditronics, a leader in manufacturing X-ray machines. Thus, Philips has gained access to cheaper, high quality goods to meeting the demands of the India market. Johnson and Johnson Medical India has also started becoming conscious of the economy conscious strata of the medical equipment industry in India over the recent past.

Points for all to stabilize and boost up the medical equipments industry in India

Experts in the arena insist on the necessity to intensify accreditation and standardization procedures in this sector to keep a watch on the quality of rapidly proliferating medical equipment manufacturers in India. Under existing conditions, no one is prevented from initiating the manufacture of medical equipments like any other small business. There is no license or permission required. In the same lines, the quality of equipments manufactured by MNCs has to be strictly monitored too. It must be ensured that the country does not become a dumping ground for any other country. The US and China have introduced FDA and SDA approval procedures respectively, to regulate those firms selling medical equipments. Similarly, installation of any medical equipment in the European Union countries requires checking whether the product carries the CE mark.

Experts in the arena insist on the necessity to intensify accreditation and standardization procedures in this sector to keep a watch on the quality of rapidly proliferating medical equipment manufacturers in India. Under existing conditions, no one is prevented from initiating the manufacture of medical equipments like any other small business. There is no license or permission required. In the same lines, the quality of equipments manufactured by MNCs has to be strictly monitored too. It must be ensured that the country does not become a dumping ground for any other country. The US and China have introduced FDA and SDA approval procedures respectively, to regulate those firms selling medical equipments. Similarly, installation of any medical equipment in the European Union countries requires checking whether the product carries the CE mark.

There is a greatly widening scope for the growth of medical equipment market in India. For instance, the diagnostic and imaging equipment industry in India valued at 1000-crores is predominantly lead by MNCs, like GE, Philips Medical Systems and Siemens. Estimates state that the sector is rapidly growing in India at a pace of 20 percent per annum. In addition, the therapeutic equipment market valued at 500-crores and supported by the domestic players is also growing at a comfortable pace of about 10 percent per annum.

The growth noticed in the high end equipment market is said to be quite substantial, while comparing the scenario today with what existed during early 80s. During those days, Actual Users Import License (AUIL) from the Ministry of Commerce was very much essential to purchase imported medical equipment. Only authorized dealers can give this license. During mid 80s, the central government abolished AUIL and liberalized the procedures to purchase medical equipments directly from foreign based firms. Compared to those days, the growth of domestic players in this arena is said to be significantly low.

Liberalization came as a boosting factor to several MNC firms. However, it did not affect the growth of the indigenous industry since though technologically they were equally sound, the domestic players predominantly manufactured middle and low-end equipments, while the MNCs concentrated on high-end equipment.

The situation has ensured that there is no clash of clientele between domestic firms and MNCs. To a great extent, the MNCs only targeted corporate and super-specialty hospitals where price is not at all a matter of concern to purchase an equipment. Not more than 0.5 per cent of the population classified as high income group can avail the treatment provided by these facilities. The domestic players mainly target nursing homes, clinics, and private and government hospitals.

The impact of the opening of health insurance on the medical equipments industry is yet to be ascertained. Only recently the healthcare insurance is made available to customers at very reasonable and attractive rates. On the other side, with a remarkable increase in the life-span of common man, insurance firms are becoming more cautious about the healthcare industry as they want to take calculated risk.

There are several factors that account for the growth of the indigenous medical equipments manufacturing industry. First and foremost, the middle-class population in India has become increasingly aware of the various diagnostic techniques available today as never before. The normal life span of common man is another significant factor. The upper age group is found spending more on health during the last five years of life than ever before. The growth of referral system and the proliferation of nursing homes have also stimulated the growth.

There are a number of hurdles faced by the domestic players in manufacturing high-end medical equipments. Some manufacturers in India find it very difficult to patch up the technology gap and stay back in catching up with the MNCs in research and development. While a number of reputed MNCs are out there in the arena for a number of years, the Indian firms need to evolve innovative methods to get hold of the necessary technology and build on it at a rapidly accelerated pace. However, the possibility of seeing a number of indigenous manufacturers in the high-end medical equipment arena is not a remote possibility. In less than a decade, this might be realized.

Experts in the field also state that it is essential for indigenous manufacturers to develop an ‘export mind set’ to ensure their sustenance in today’s economy. While India has grabbed more than a two percent share of the world’s medical equipment market, it can certainly grow at an accelerated pace if the manufactured equipments are governed by quality and cost concerns shared by the export market.

Medical equipment manufacturing is necessarily a low volume industry requiring a highly intellectual and manual effort. The reasons are the stress lying on designing, enhancing embedded software capabilities, testing procedures, simulation methods and clinical trials.

Under the present scenario, it is absolutely essential to ensure global benchmarking in the delivery of quality and performance. International quality certifications for manufacturing and service support systems will certainly boost up developing export business. However, one of the greatest challenges in the segment is to build marketing capabilities in the markets outside India. By such measures, the medical equipments manufacturing industry in India can take a major step ahead towards a bright future.